Table of Content

Many countries have similar concepts or agencies that define what are "standard" mortgages. Regulated lenders may be subject to limits or higher-risk weightings for non-standard mortgages. For example, banks and mortgage brokerages in Canada face restrictions on lending more than 80% of the property value; beyond this level, mortgage insurance is generally required.

Because of all the criticisms from real estate industry, Canada finance minister Bill Morneau ordered to review and consider changes to the mortgage stress test in December 2019. In an attempt to cool down the real estate prices in Canada, Ottawa introduced a mortgage stress test effective 17 October 2016. For high-ratio mortgage (loan to value of more than 80%), which is insured by Canada Mortgage and Housing Corporation, the rate is the maximum of the stress test rate and the current target rate. However, for uninsured mortgage, the rate is the maximum of the stress test rate and the target interest rate plus 2%. This stress test has lowered the maximum mortgage approved amount for all borrowers in Canada.

Contact VA Home Loans Service

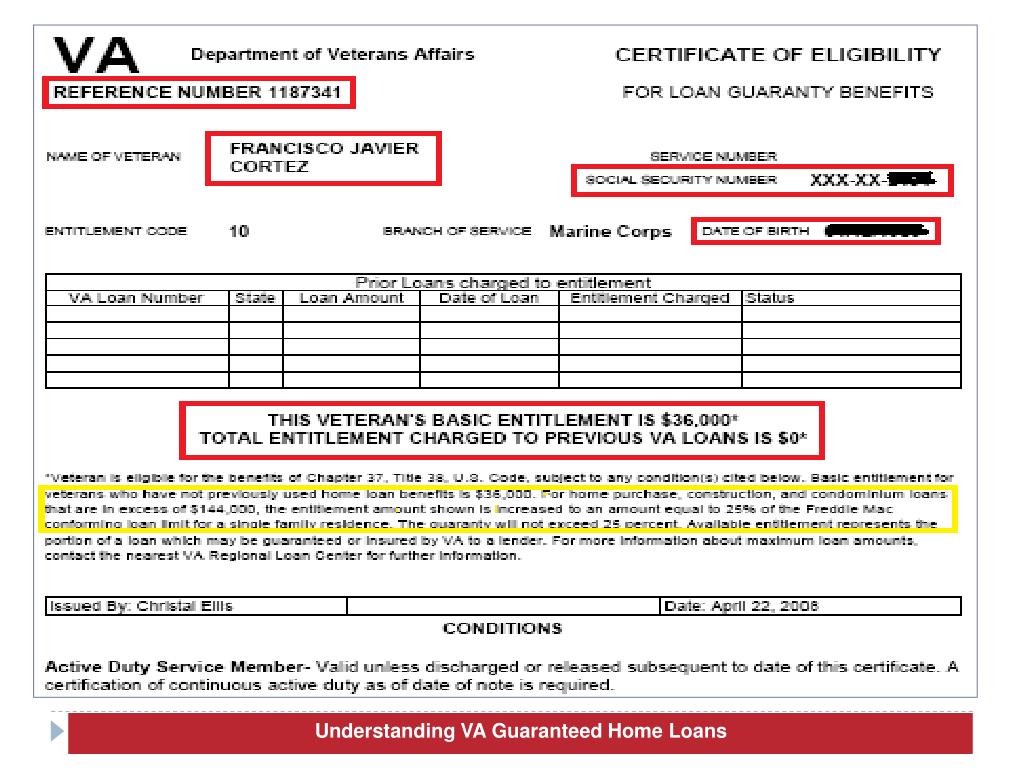

The VA does not have a minimum credit score used for pre-qualifying for a mortgage loan, however, most Lenders require a minimum credit score of at least 620. The Veterans Housing Act of 1970 removed all termination dates for applying for VA-guaranteed housing loans. This 1970 amendment also provided for VA-guaranteed loans on mobile homes. Find out if you're eligible and how to apply for a VA home loan COE as the surviving spouse of a Veteran or the spouse of a Veteran who is missing in action or being held as a prisoner of war.

Of 1978 expanded and increased the benefits for millions of American veterans. This guide can help you under the homebuying process and how to make the most of your VA loan benefit.Download the Buyer's Guide here. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Mortgage underwriting

You can track your credit by studying and building up your credit score. Your credit score is calculated based on your payment history, the amount of money you owe, the length of your credit history, and the types of credit you have. Before a bank will lend you a large sum of money to purchase a house with (i.e., a mortgage), you will need to prove to the bank that you have the financial ability to manage such a loan. Refinancing Loans.50%Manufactured Home Loans1.00%Loan Assumptions.50%Veterans who previously lived in a home they had to then rent out will typically qualify for a no appraisal Interest Rate Reduction Refinance.

VA loans allow veterans to qualify for loan amounts larger than traditional Fannie Mae / conforming loans. Veterans have been known to be approved with a DTI of up to 80%, if there are other factors that strengthen their loan application. These factors include a low Loan-To-Value , sufficient residual income, additional income received but not used to qualify for the loan, good credit, etc... The charge to the borrower depends upon the credit risk in addition to the interest rate risk. The mortgage origination and underwriting process involves checking credit scores, debt-to-income, downpayments, assets, and assessing property value.

Veterans United Home Loans Amphitheater

In order to be eligible for a VA home loan as a current, active duty member of the military, you will need to have been serving for 90 or more continuous days. If you are an active reservist or national guard member, you must have at least 6 years of service. These numbers may change if you were, or are, ever called to active duty. In some circumstances, you may want to refinance your mortgage in order to get a lower interest rate. If you choose this benefit, the VA offers an Interest Rate Reduction Refinance Loan .

As an initial matter, you can only qualify for a VA home loan if you are using the home for your own personal occupancy. The PMI company insures a percentage of the consumer's loan to reduce the lender's risk; this percentage is paid to the lender if the consumer does not pay and the lender forecloses the loan. If the ROV does not yield a higher value and the seller is unwilling to negotiate a reduced sale price, the buyer may have the option to pay the difference in cash at closing. The lender will review the appraisal when it is complete to ensure it meets their underwriting standards, and there is sufficient collateral to complete the home loan. You may also complete the Monthly Payment Worksheet, or use thismortgage calculator to help you calculate what an affordable mortgage payment is for you.

Surveyor and conveyor or valuation fees may also apply to loans but some may be waived. The survey or conveyor and valuation costs can often be reduced, provided one finds a licensed surveyor to inspect the property considered for purchase. The title charges in secondary mortgages or equity loans are often fees for renewing the title information. Home equity loans and lines of credit are usually, but not always, for a shorter term than first mortgages. Home equity loan can be used as a person's main mortgage in place of a traditional mortgage. However, one cannot purchase a home using a home equity loan, one can only use a home equity loan to refinance.

Others also worried about the potential flood of applicants and impact on inflation given the program's two-year purchase window. Private mortgage insurance guarantees conventional home mortgage loans - those that are not guaranteed by the government. This loan program is a private sector equivalent to the Federal Housing Administration and VA loan programs.

A biweekly mortgage has payments made every two weeks instead of monthly. A VA loan is a mortgage loan in the United States guaranteed by the United States Department of Veterans Affairs . The VA does not originate loans, but sets the rules for who may qualify, issues minimum guidelines and requirements under which mortgages may be offered and financially guarantees loans that qualify under the program. Budget loans include taxes and insurance in the mortgage payment; package loans add the costs of furnishings and other personal property to the mortgage. Buydown mortgages allow the seller or lender to pay something similar to points to reduce interest rate and encourage buyers.

This pre-approval will make the home shopping and purchasing process a lot easier. Being pre-approved shows sellers that you are serious and that you can afford the homes you are looking at. If your previous home was purchased using a VA Loan, and that loan was paid off by the new owners, the full entitlement may have been restored.

Your lender may also ask you to provide more information or documents at this time. A study issued by the UN Economic Commission for Europe compared German, US, and Danish mortgage systems. The German Bausparkassen have reported nominal interest rates of approximately 6 per cent per annum in the last 40 years . German Bausparkassen are not identical with banks that give mortgages.

There are many types of mortgages used worldwide, but several factors broadly define the characteristics of the mortgage. All of these may be subject to local regulation and legal requirements. Just six years later, the program celebrated its 24 millionth loan. The VA will honor Army SFC William Kopf as the recipient of that milestone loan during a ceremony in early June, just a couple weeks before the actual 75th anniversary of the GI Bill.

No comments:

Post a Comment